Discounted future cash flow calculator

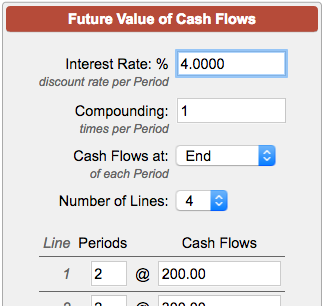

T - Time associated. The free cash flow calculator calculates the terminal value at the end of year 5 and the present value PV of the terminal cash flow today.

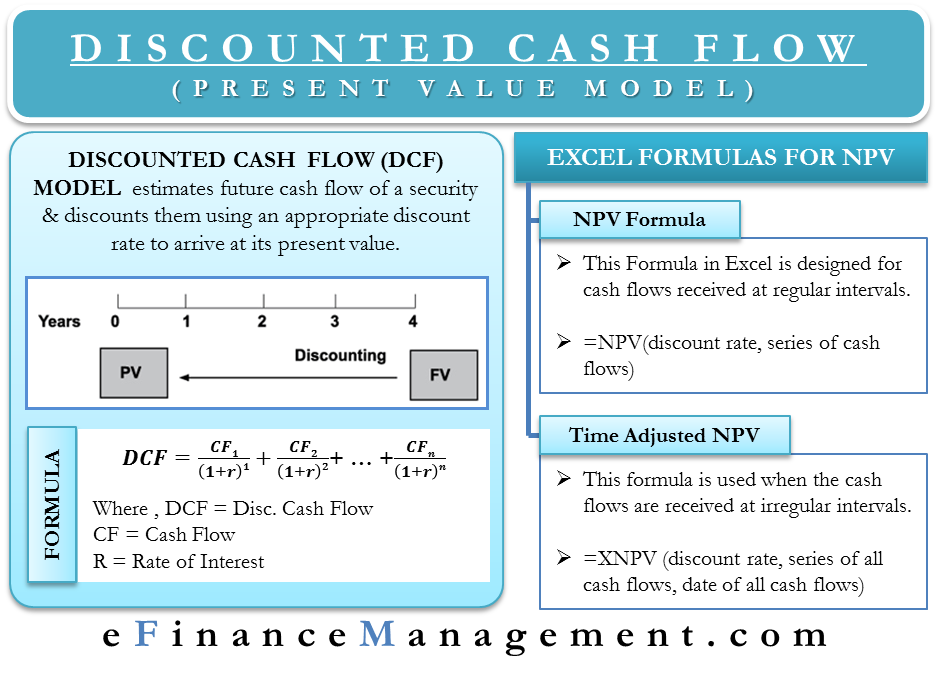

Discounted Cash Flow Model Formula Example Interpretation Efm

Ad For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online.

. It helps to calculate the actual value of the asset or. Explore Tools That Allow You To Access Insights On Retirement Concerns. Build Your Future With a Firm that has 85 Years of Investment Experience.

Access the worlds largest source of deal multiples and valuations see whats possible. Build Your Future With a Firm that has 85 Years of Investment Experience. The income approach the cost approach or the market comparable sales approach.

Discounted Cash-flow Model is a quantitative method that calculates a companys stock price based on the sum of all future free cash flow earned from that company at a discount rate. Free Trial - Track Sales Expenses Manage Inventory Prepare Taxes More. Initial FCF Rs Cr Take 3 Years average.

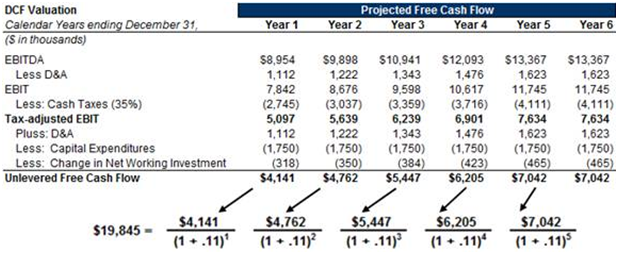

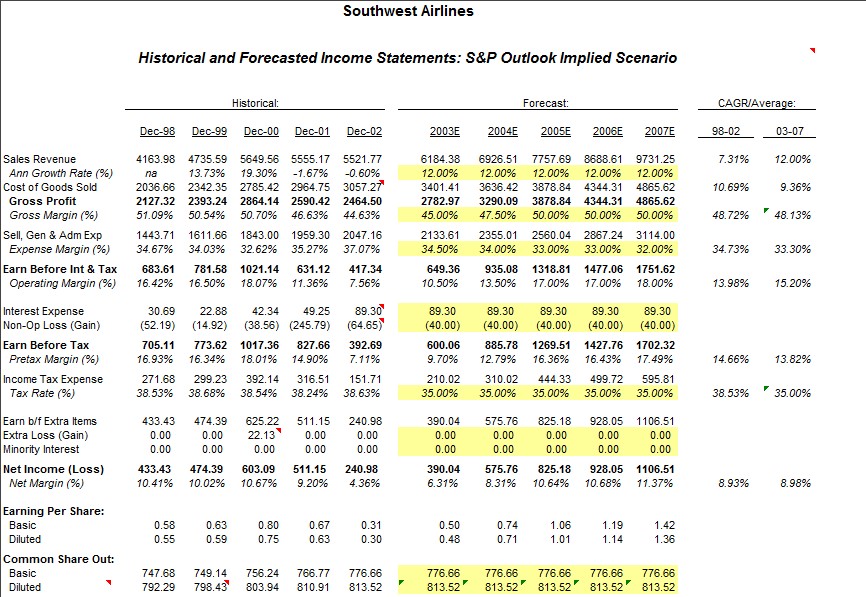

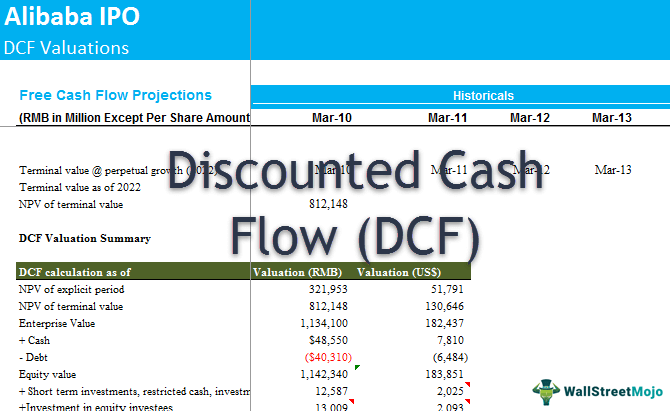

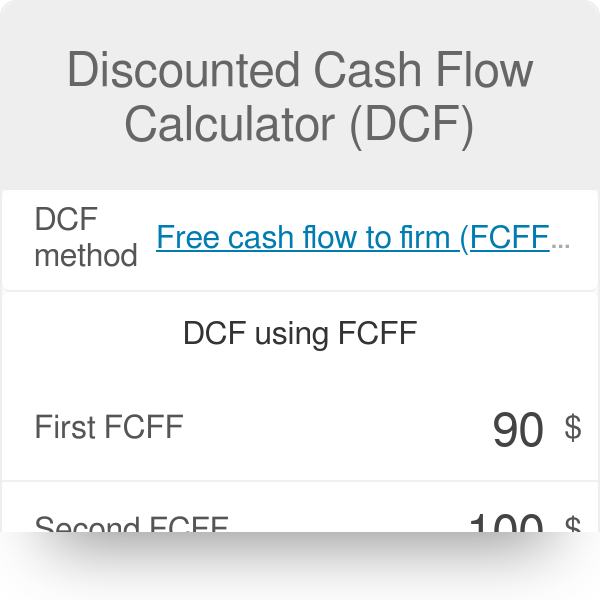

Discounted Cash Flow Calculator. To calculate the enterprise value the present value of cash flows for the years from now till the end of the forecast period are divided by the discount rate and then added. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

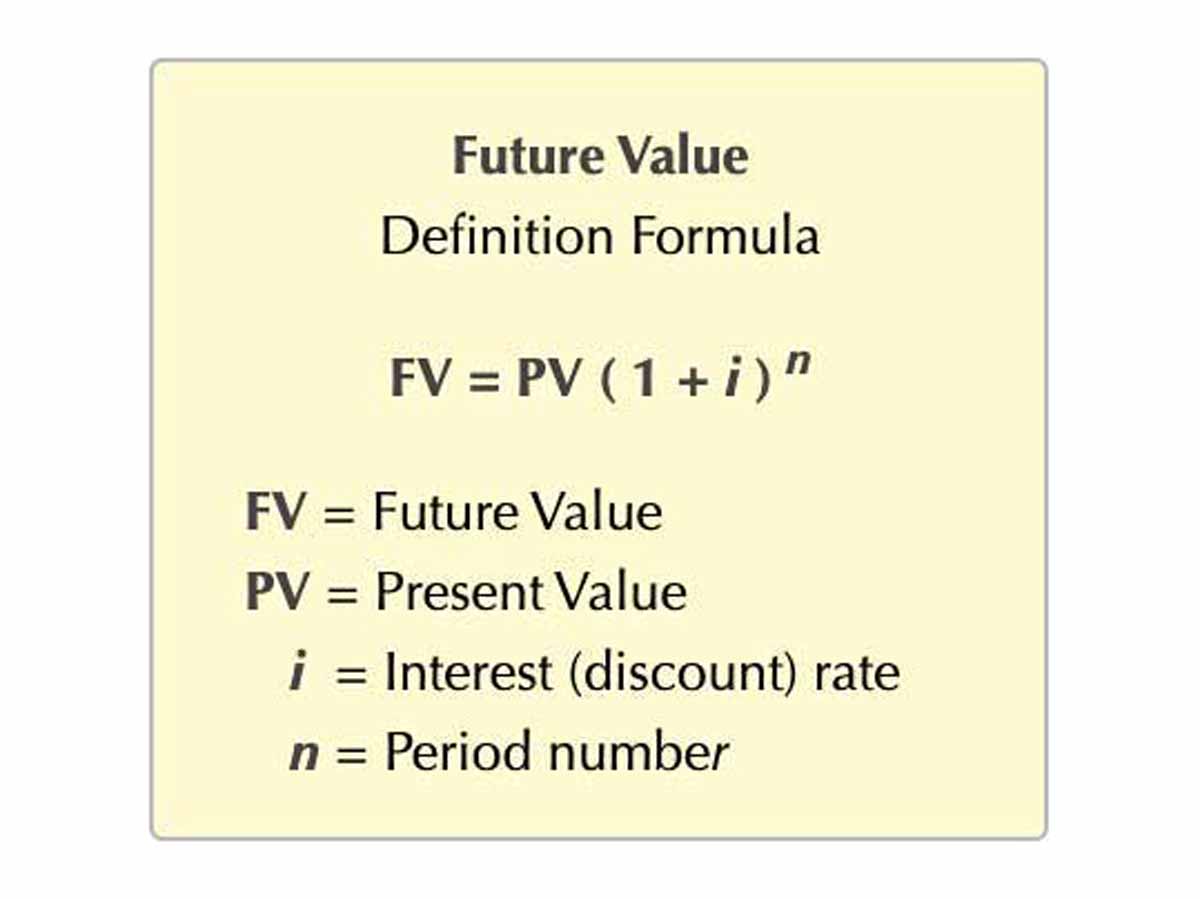

The discounted cash flow valuation. As an alternative to the more abbreviated income capitalization approach this methodology is more relevant where future operating conditions and cash flows are variable or not projected. The discounted cash flow formula to calculate growth value terminal value and Intrinsic value is as follows.

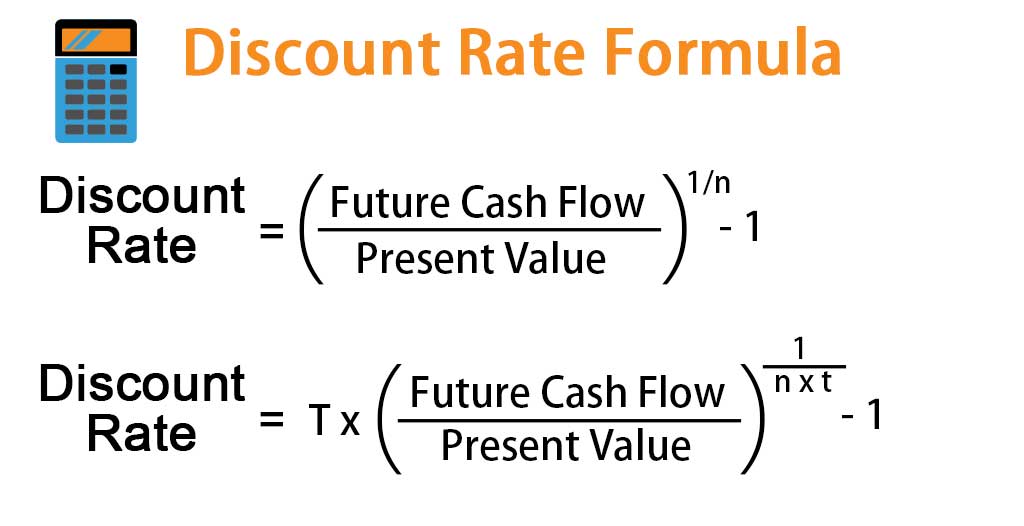

1r 1 1r 2 1r n. Coefficient A 1 g 1 r. Business valuation is typically based on three major methods.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Calculation of Discounted Cash Flow DCF DCF analysis takes into consideration the time value of money in a compounding setting. Business Valuation - Discounted Cash Flow Calculator.

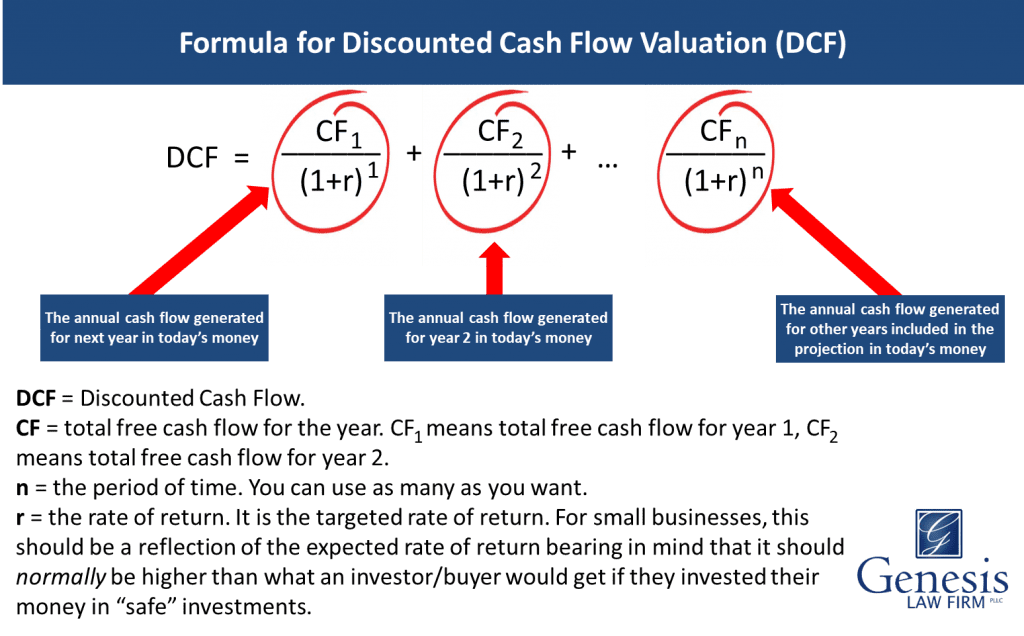

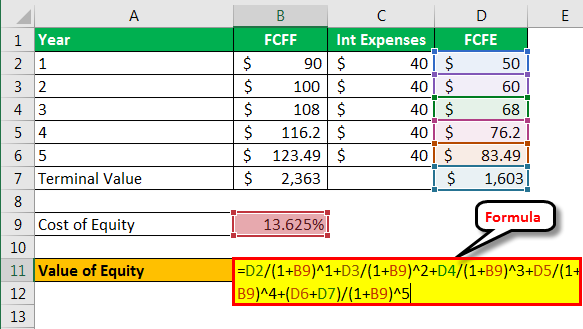

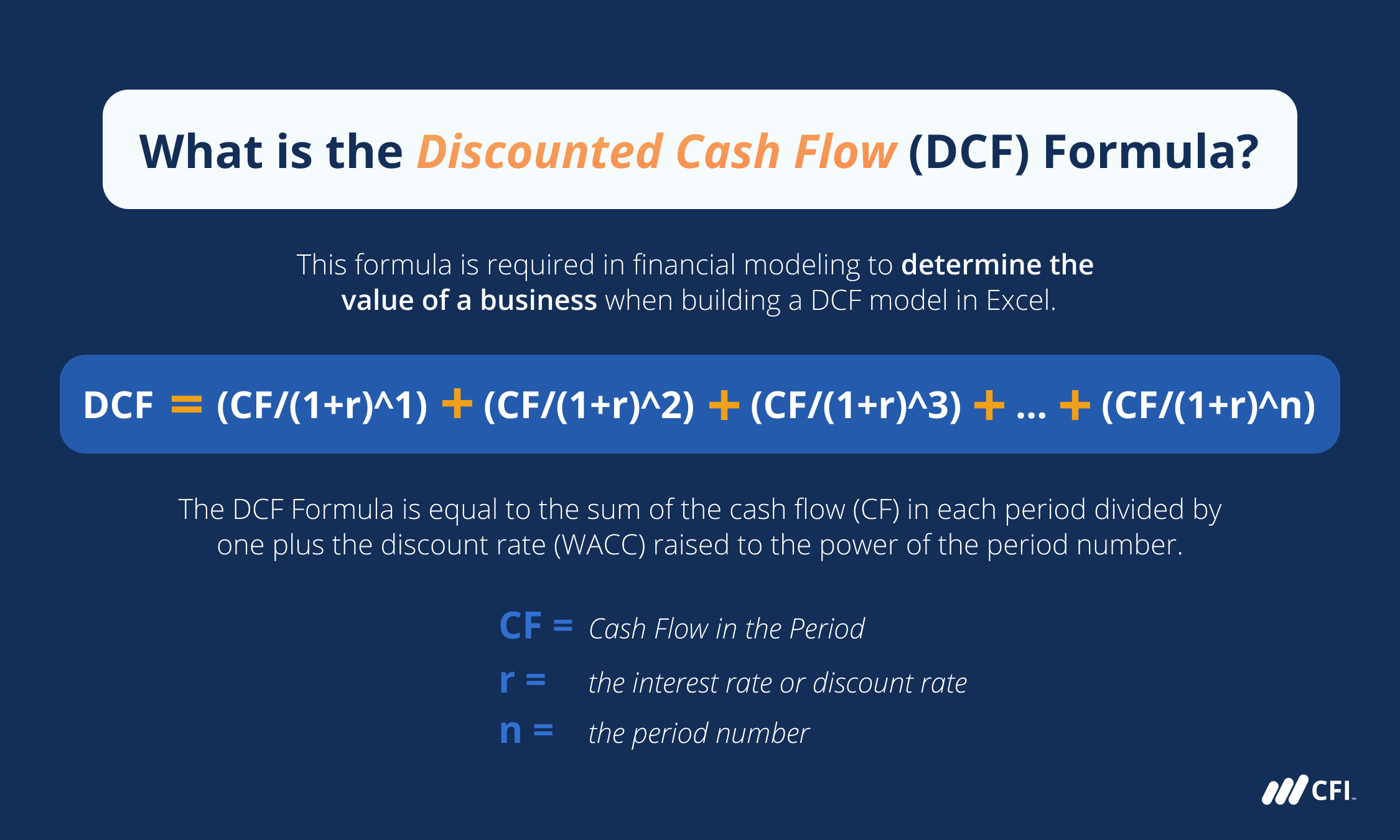

After forecasting the future cash flows and. Ad Get more accurate data for financial models build and analyze comps quickly. DCF FCFFt 1 rt where FCFF - Free cash flow to the firm and represents the future expected cash flows of the company.

The discounted cash flow DCF formula is. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Heres our Discounted Cash Flow DCF Calculator for your ease of calculation so that you dont have to break your head in complicated excel sheets.

The fair value of a. Business valuation BV is typically based on one of three methods. If an investor were to pay less than this amount the rate of return would be higher than the.

The discounted cash flow formula uses a cash flow forecast for future years discounted back. The income approach the asset approach and the market comparable. The main discounted cash flow formula is.

DCF CF1 CF2. With the Discounted Cash Flow analysis the value of the company is 209 billion.

Discounted Cash Flow Calculator Calculate Dcf Of A Stock Business Investment

Present Value Of A Single Cash Flow Finance Train

How To Use Discounted Cash Flow Time Value Of Money Concepts

Excel Discount Rate Formula Calculation And Examples

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Future Value Of Cash Flows Calculator

The Discounted Cash Flow Dcf Valuation Method Magnimetrics

Discounted Cash Flow Analysis Street Of Walls

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

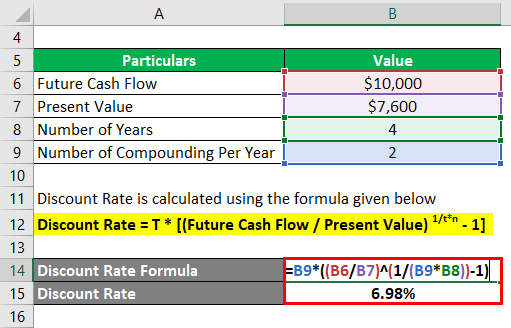

Discount Rate Formula How To Calculate Discount Rate With Examples

Discounted Cash Flow Analysis Study Com

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

How To Calculate Discounted Cash Flow For Your Small Business

Discount Rate Formula How To Calculate Discount Rate With Examples

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Discounted Cash Flow Calculator Dcf